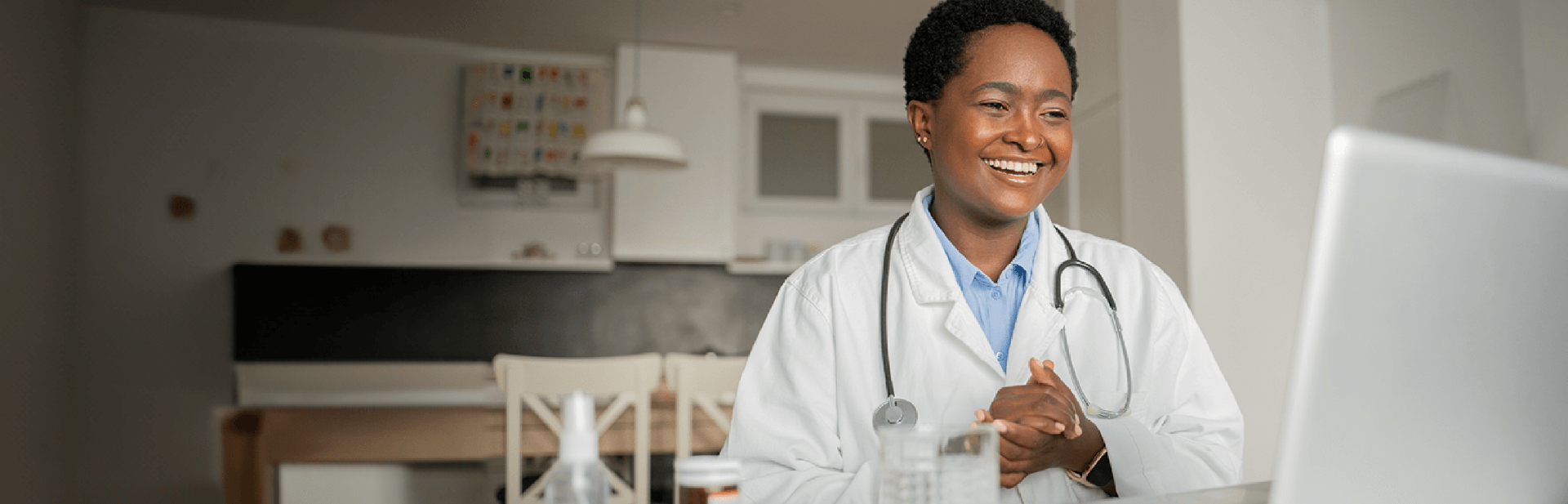

The financial education you didn't get in med school.

Explore tools and resources for your financial peace of mind.

Not sure where to start? Personalize your content below.

Content Collections

Our curated collections of interactive financial content are designed to help you reach your goals on your own time, at any career stage.

Managing Medical School Debt for Residents

Student loan debt helped you become a doctor, but you don’t want it to weigh you down. Here are so ...

Managing Student Loans & Finances for Residents

Refinancing Options For Medical Residents

4 Reasons to Refinance Your Student Loans

Medical Student Loan Repayment

Paying off Your Student Loans Part 1: Setting Yourself Up for Success

Student Loan Forgiveness for Doctors: An Overview

Actionable Strategies to Manage Student Loan Debt

Guide to Student Loan Consolidation

7 Jobs That Can Get Student Loan Forgiveness

How PSLF Can Help Doctors Serve Communities in Need

How Long Does It Take to Pay Off Medical School Debt?

Medical Student Debt: Consolidation or Refinancing

Paying Off Your Student Loans Part 2: Forbearance and Forgiveness

The Penalties for Missing Student Loan Payments

A Financial Planning Guide for Residency

Saving Strategies for Physicians

Whether you're saving for an emergency fund, retirement, a down payment, or something else, here are ...

High Yield Savings Calculator

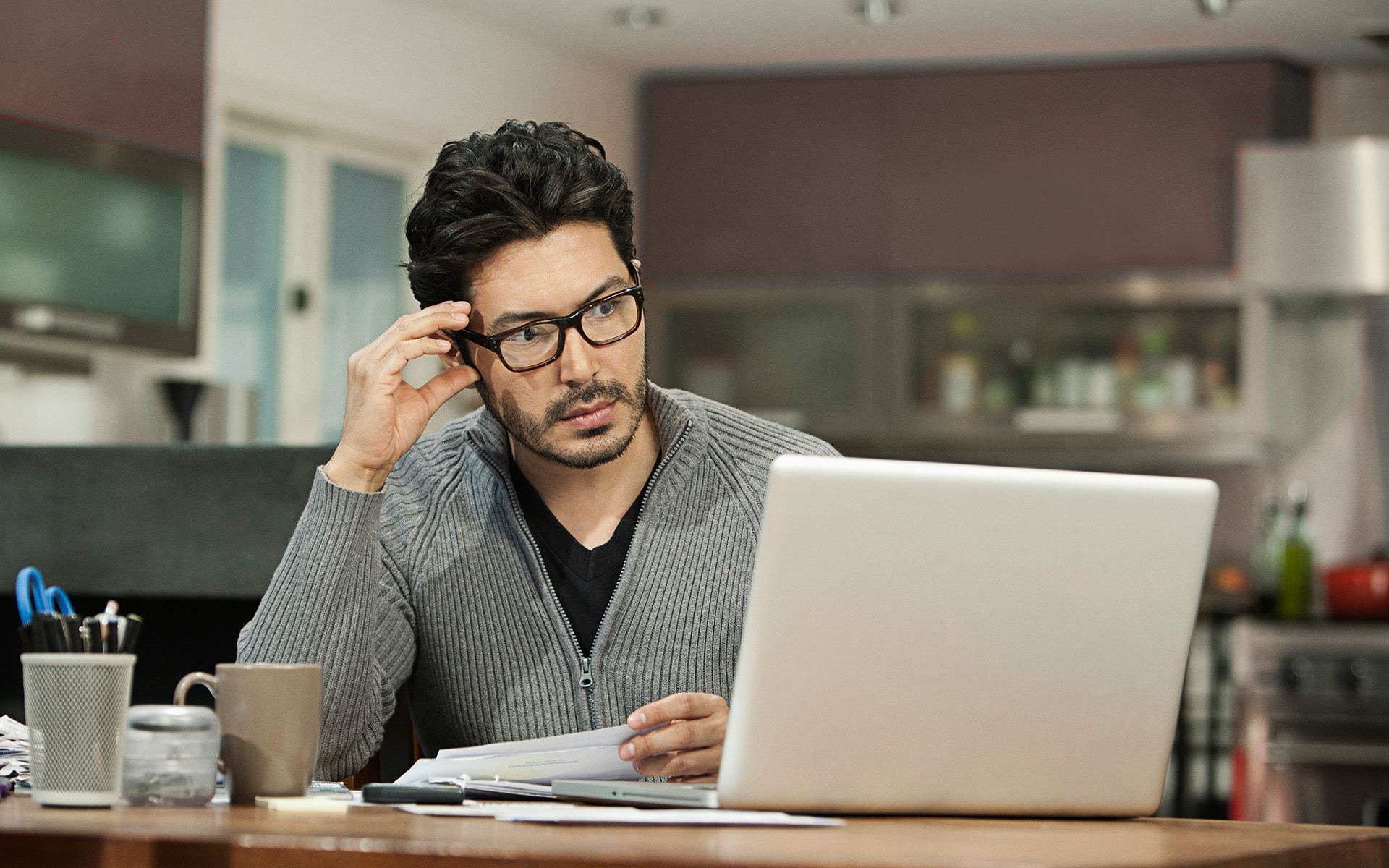

Budgeting 101 for Physicians

Quick Budgeting Tips for Doctors

How a Small Change in Your Loan Interest Rate Can Make a Big Difference

How Much Doctors Should Save for an Emergency Fund

Why Residents and Early Attendings Need to Budget

5 Habits to Help Doctors Avoid Lifestyle Inflation

Investing for Doctors: Investment Fundamentals

Healthy Financial Habits for Physicians

While it may not have been your focus in med school, you'll still need financial literacy throughout ...

Debt-to-Income Calculator

Mortgages for Doctors: What You Need to Know about Private Mortgage Insurance (PMI)

Guide to Improving Your Credit Score

Budgeting 101 for Physicians

Managing Lifestyle Creep

What is a Soft Credit Check vs. a Hard Credit Check?

How Much Doctors Should Save for an Emergency Fund

5 Habits to Help Doctors Avoid Lifestyle Inflation

Investing for Doctors: Investment Fundamentals

Homebuying for Physicians

Purchasing a house is a major milestone. Learn the ins and outs of mortgages to help you prepare for ...

Mortgages: Physician Loan vs. Conventional Loan

Mortgage Down Payment Calculator

A Guide to Understanding Mortgages

Talking Physician Mortgages with Dr. Juneja and Dr. Shah

How to Apply for a Mortgage, Loan, or Refinance When You’re Self-Employed

How Much Down Payment Do Doctors Need to Buy a Home?

What is PMI?

Understanding Physician Mortgages

Managing Your Own Practice

When you're considering opening, expanding, or managing your own practice – there's a lot to consi ...

7 Step Guide to Opening a Medical Practice

7 Common Mistakes Made When Starting Your Own Practice

6 Reasons Doctors Should Consider Private Practice

The Exit Strategy to Owning a Practice

Hiring a Staff, Building a Team for Your Practice

Economics of Starting Your Own Practice

Buying Your Own Practice

A Checklist to Starting Your Own Practice

Financial Foundations for Dentists

While it may not have been your focus during dental school, you'll still need financial literacy thr ...

Talking PSLF with Three Doctors Who Reached Student Loan Forgiveness

APR vs APY: What’s the Difference?

Do Your Goals Pass the SMART Test?

Your FICO Credit Score – What is it and why is it important?

What is Debt-to-Income Ratio?

What is Compound Interest?

The Five Basics of Financial Success for Dentists

Investment Planning for Physicians

Understanding investing can be complicated. These articles will help demystify some common investing ...

Investing for Doctors: Is Low-Risk Investing a Good Investment Strategy for You?

5 Common Investor Mistakes

Diversification – What Is It and Why You Need It

How to Create an Investment Plan

Passive vs. Active Investing

What is Your Risk Tolerance?

Getting a Mortgage as a Resident

If you're ready to buy a home as a resident, explore some of the options available for doctors, lear ...

Mortgages for Doctors: What You Need to Know about Private Mortgage Insurance (PMI)

Why a Physician Mortgage Makes Sense at Different Career Stages

Getting a Mortgage: What to Expect From Closing

Talking Physician Mortgages with Dr. Juneja and Dr. Shah

Getting a Mortgage When You Still Have Student Loan Debt

How Much of a Down Payment Do You Need to Buy a House?

Debt Consolidation for Physicians

Consolidating debt can be one of the best strategies for saving money, staying on time with payments ...

Taking Out a Personal Loan

Consolidating Debt With a Personal Loan

Talking Smart Finances With the OncDoc, Dr. Sanjay Juneja

Medical Student Loan Repayment

The Five Basics of Financial Success for Physicians

Taking Out a Personal Loan

Paying Off Debt with Personal Loans

Career Essentials for Physicians

From balancing your medical career to starting a practice, physicians face unique career and financi ...

Pursuing Passions with the I’m Also a Doctor Docuseries

7 Common Mistakes Made When Starting Your Own Practice

Life Insurance for Physicians

Understanding Disability Insurance for Doctors

Creating a Financial Plan for Physicians

How to Create an Investment Plan

How to Create a Simple 50/30/20 Budget

Eligibility Criteria for the SAVE Plan

Quick Budgeting Tips for Doctors

Do Your Goals Pass the SMART Test?

What Is Student Loan Forbearance?

Managing Lifestyle Creep

What is an APR?

Fixed vs. Variable Interest Rates

What is APY?

Why Would I Want to Switch Banks?

Why Are Mortgage Rate Locks a Good Idea?

What is Debt-to-Income Ratio?

What is PMI?

What is Compound Interest?

Your Road Home

Mortgage Maximum Affordability

Paying Off Debt With the Debt-Free Nurse

Financial Advice for the Pandemic

Let’s Talk About Finances, Baby

OK, Boomer, You’re Kinda Awesome

Tools & Calculators

All Resources

Don’t miss the latest financial resources.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Get tailored Laurel Road resources delivered to your inbox.

Search Results