Helping you take control of your financial future.

Explore tools and resources for your financial peace of mind.

Not sure where to start? Personalize your content below.

Content Collections

Our curated collections of interactive financial content are designed to help you reach your goals on your own time.

Return of Student Loan Payments: What You Need to Know

Browse this collection to learn more about the return of student loan payments and coinciding change ...

Saving on a Valuable Education (SAVE), Explained

How to Prepare for Student Loan Consultation

What Can I Expect During My Consultation With a Student Loan Specialist?

Managing PSLF and IDR Plans When Payments Resume in October

What If My Loan Servicer Has Changed Since COVID?

Calculate Monthly Payments Under SAVE Plan: for Graduate and Undergraduate Loans

Interest Accrual Changes in the New SAVE Plan

Will I Be Ineligible for Future Forgiveness if Enrolled in SAVE?

Eligibility Criteria for the SAVE Plan

Recent Changes to Income-Driven Repayment (IDR) Plans

Unpacking a Summer of Student Loan News with JPG

Comparing Income-Driven Repayment (IDR) Plans

If you have federal student loans, you could have multiple paths to forgiveness through an IDR plan. ...

Pros and Cons of Income-Driven Repayment (IDR)

Saving on a Valuable Education (SAVE), Explained

Interest Accrual Changes in the New SAVE Plan

Recent Changes to Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) Income Limits

Types of Income-Driven Repayment Plans for Your Career

A Guide to Pay As You Earn (PAYE) Student Loan Repayment

What is Income-Contingent Repayment (ICR)?

The 411 on Income-Based Repayment (IBR)

Building Healthy Financial Habits

Healthy habits can help you build a strong financial foundation keep you on track to achieve your go ...

Managing Lifestyle Creep

How to Create a Simple 50/30/20 Budget

Guide to Improving Your Credit Score

50/30/20 Budget Calculator

Debt-to-Income Calculator

Balancing Student Loan Stress and Mental Health

Let’s Talk About Finances, Baby

A Practical Guide to Financial Independence for Young Professionals

Don’t Fall for Fraud – How to Spot Red Flags

Managing Student Loan Debt

Student loans were an investment in you – don't let them weigh you down. Explore student loan op ...

Guide to Student Loan Repayment

Balancing Student Loan Stress and Mental Health

4 Reasons to Refinance Your Student Loans

Who Qualifies for Student Loan Refinancing?

What Is Student Loan Forbearance?

How To Pay Off Student Loans

Actionable Strategies to Manage Student Loan Debt

Guide to Student Loan Consolidation

Navigating Student Loan Repayment: DOs and DON’Ts

Does Paying Off My Student Loans Impact My Credit Score?

Federal vs. Private Student Loans: What’s the Difference?

7 Jobs That Can Get Student Loan Forgiveness

Why You Should Pay Off Your Student Loans Over Time

The Penalties for Missing Student Loan Payments

Planning for Your Financial Goals

The financial future you envision requires planning. With these tools and tips, you can understand h ...

How to Create an Investment Plan

Do Your Goals Pass the SMART Test?

What is Your Risk Tolerance?

Passive vs. Active Investing

Why Would I Want to Switch Banks?

Diversification – What Is It and Why You Need It

Does Paying Off My Student Loans Impact My Credit Score?

How to Get Student Loan Forgiveness

In this collection, gain a deep understanding of federal student loan forgiveness programs such as I ...

How to Get Student Loan Forgiveness

What Jobs Qualify for Public Service Loan Forgiveness (PSLF)?

Public Service Loan Forgiveness (PSLF) Program Explained

How to Apply for Student Loan Forgiveness

Is Student Loan Forgiveness Taxable?

How to Apply for an Income-Driven Repayment Plan

Student Loan Forgiveness for Nonprofit Workers

How to Get Student Loan Forgiveness with Income-Driven Repayment

Federal Student Loan Repayment Programs: An Overview

Why You Should Pay Off Your Student Loans Over Time

How to Get Forgiveness on Parent PLUS Student Loans

Student Loan Forgiveness Scams and How to Avoid Them

How to Buy Your First Home

Buying your first home is an important milestone and major financial decision. Explore the ins and o ...

First-Time Homebuyer Tips

Mortgage Down Payment Calculator

5 Tips to Make Applying for Your First Mortgage Easier

A Guide to Understanding Mortgages

What’s the Difference between Mortgage Pre-Qualification and Pre-Approval?

What is PMI?

Getting a Mortgage: What to Expect From Closing

What to Look for in a New Home (and What to Ignore)

Comparing Student Loan Repayment Options

If you have federal student loans, you could have access to different repayment options – includin ...

Guide to Federal Student Loan Repayment Programs

Public Service Loan Forgiveness (PSLF) Program Explained

Learn the Best Way to Pay Off Your Student Loans

What Is the Standard Repayment Plan for Federal Student Loans?

How to Get Student Loan Forgiveness

How to Get Student Loan Forgiveness with Income-Driven Repayment

Saving on a Valuable Education (SAVE), Explained

Guide to Student Loan Consolidation

How to Get Forgiveness on Parent PLUS Student Loans

Pros and Cons of Income-Driven Repayment (IDR)

Student Loan Forgiveness Scams and How to Avoid Them

Building Your Savings

Whether you're saving money for an emergency, retirement, a down payment, or a dream vacation, here ...

How to Build an Emergency Fund

What is Compound Interest?

The Benefits of Digital Banking and Going Cashless

50/30/20 Budget Calculator

Student Loan Cashback Calculator

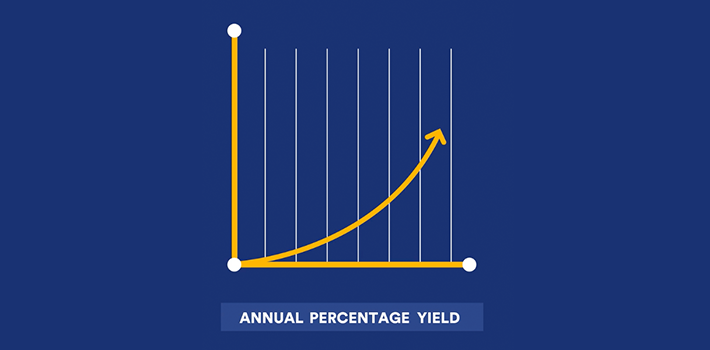

What is APY?

High Yield Savings Account vs CD: A Guide

Open a Checking Account with Direct Deposit Bonuses

How to Switch to One Bank for All Your Checking and Savings Needs

High Yield Savings Calculator

How to Use Direct Deposit to Reach Your Savings Goals

Financial Foundations for Professionals

Build your financial knowledge with an understanding of core personal finance principles and importa ...

Your FICO Credit Score – What is it and why is it important?

What is Debt-to-Income Ratio?

APR vs APY: What’s the Difference?

Do Your Goals Pass the SMART Test?

What is a Soft Credit Check vs. a Hard Credit Check?

What Are Principal and Interest Payments?

How to Protect Yourself from Common Scams

A Practical Guide to Financial Independence for Young Professionals

Don’t Fall for Fraud – How to Spot Red Flags

How to Create a Simple 50/30/20 Budget

Eligibility Criteria for the SAVE Plan

Do Your Goals Pass the SMART Test?

What Is Student Loan Forbearance?

Managing Lifestyle Creep

What is an APR?

Fixed vs. Variable Interest Rates

What is APY?

Why Would I Want to Switch Banks?

Why Are Mortgage Rate Locks a Good Idea?

What is Debt-to-Income Ratio?

What is PMI?

What is Compound Interest?

Your Road Home

Mortgage Maximum Affordability

Paying Off Debt With the Debt-Free Nurse

Financial Advice for the Pandemic

Let’s Talk About Finances, Baby

OK, Boomer, You’re Kinda Awesome

Tools & Calculators

All Resources

Don’t miss the latest financial resources.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Get tailored Laurel Road resources delivered to your inbox.

Search Results