How Nurses Can Save for Retirement

With the right budgeting, a nurse's salary can support a healthy retirement plan, where tax-advantaged retirement accounts offer ways for nurses to maximize savings.

As a nurse, building a savings and retirement plan that’s aligned with your career path and financial goals comes with its own unique challenges. The good news is that whether you work for the government, a non-profit, a private organization or yourself, there are different types of retirement plans you can start taking advantage of to prepare for your post-career life.

Set your retirement goals

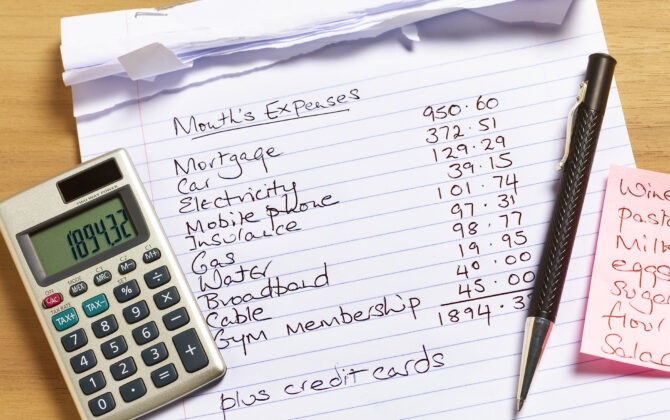

Before you start contributing to a retirement account, it’s important to take inventory of your finances, set a budget, and clearly define your financial goals in the near and short term. This will allow you to set accurate, realistic retirement goals so you can align your accounts and manage your risk while saving for retirement.

Review your types of retirement plans

Depending on your employer, there are different types of retirement plans with unique features and benefits available to you. Nurses working in public sectors, for example, can benefit from exclusive plans. Pensions as well as private (non-employer) methods of building retirement savings may also be available.

For nurses employed by the Federal government

If you’re employed by the Federal government, you’ll have access to the Thrift Savings Plan (TSP), a tax-deferred retirement savings and investment plan that gives Federal employees the same type of savings and tax benefits that many private corporations offer their employees under 401(k) plans. By taking advantage of the TSP, Federal employees can save a portion of their income for retirement, receive matching agency contributions, and reduce their current taxes.

For nurses employed by a public organization

As a nurse employed by a public school (including state colleges and universities) or certain 501(c)(3) tax-exempt organizations, you can enroll in a 403(b) plan, also known as a tax-sheltered annuity plan. Employees eligible for a 403(b) plan can take advantage of tax-exempt contributions by setting aside some of their salary each paycheck to be automatically put in their retirement account. Additionally, employers may contribute to the plan for employees through a match program.

For nurses employed by the state or by a tax-exempt organization

Nurses employed by state or local governments can take advantage of 457(b), 401(a) or pension plans to save for retirement. Plans eligible under 457(b) give employees the benefit of deferring income taxation on retirement savings into future years.

With a 401a plan, your employer is required to contribute to the plan. Typically, employers offering a 401(a) plan will set their employees’ contribution amount, and usually employee participation is mandatory. If you leave the organization, you can usually withdraw your vested money by rolling it over into another qualified retirement savings plan or purchasing an annuity. As for less common pension plans, the main difference between them and other employer-sponsored retirement plans is that a pension guarantees you a set monthly income for life after you retire. In a pension plan, contributions are made by the employer to an investment portfolio managed by an investment professional and come with significantly less market risk for employees compared to a 401(k). In some cases, employees may also make contributions.

Retirement plans available through some private employers

In the private sector, one of the most common types of retirement plan benefits offered is a 401(k). In a 401(k) plan, you have the freedom to choose how much pre-tax income you want to contribute (up to a certain limit set by the IRS) and your employer may or may not offer a matching contribution.

Private retirement plans

Once the above tax-advantage and employer-sponsored plans are maximized for contributions, you can also look at private plans to meet and exceed your retirement savings goals.

Investment Retirement Accounts (IRAs)

Investment Retirement Accounts (IRAs) come in for different types:

- Traditional IRA – Contributions made to a traditional IRA may be fully or partially tax deductible, depending on your filing status and income. Generally, investments in your IRA are not taxed until you take a distribution (withdraw) from the account.

- Roth IRA – Unlike a traditional IRA, contributions to a Roth IRA are not tax deductible, however, qualified withdrawals are tax-free. In other words, you’ll pay tax on the money when you put it into a Roth IRA, but when you’re ready to withdraw your investments during retirement, you won’t have to pay tax. Compared to a traditional IRA, a Roth IRA can be advantageous because you’re paying tax on the presumably smaller amount of money now, and paying no tax on the larger amount of money that your investments have grown into over the years.

- Rollover IRA – A rollover IRA is an investment vehicle you can use if/when you leave a job that had a 401(k) plan. A rollover IRA allows you to transfer assets from your old employer-sponsored retirement account into a traditional IRA and avoid immediate taxes. Your retirement savings will continue to grow tax-deferred in a rollover IRA.

- Simplified Employee Pension Plan (SEP) – A SEP plan allows employers to contribute to traditional IRAs (SEP-IRAs) set up for employees. A business of any size, even self-employed, can setup a SEP, and employers can contribute up to 25 percent of each employee’s pay.

- SIMPLE IRA – Designed for the self-employed or small businesses with 100 employees or less, a SIMPLE IRA follows the same investment, distribution and rollover rules as traditional IRAs. It provides small employers with a simplified method to contribute toward their employees’ and their own retirement savings. As an employee, you may choose to make salary reduction contributions and your employer is required to make either matching or nonelective contributions. Contributions are made to an Individual Retirement Account or Annuity (IRA) set up for each employee.

Once you’ve decided on your retirement account type, make sure you understand your options for investing those funds. You may be able to talk to a financial professional through your retirement benefits plan and have an opportunity to get all of your questions answered.

Reduce debt and build your retirement savings budget

Once you have selected the best retirement plan and cadence for saving that works with your budget, you can focus on reducing debt via options like student loan refinancing or consolidation loans. Once you have a strategy for reducing debt, you can create an emergency savings fund while also regularly contributing to a retirement savings plan that maximizes contributions.

Rebalance your investments annually

Regularly reviewing retirement investments for adjustments as you move through different stages of life and your financial goals change is important. Make sure changes in your income (i.e. when you get a raise) are reflected in your retirement savings strategy.

In providing this information, neither Laurel Road or KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Any third-party linked content is provided for informational purposes and should not be viewed as an endorsement by Laurel Road or KeyBank of any third-party product or service mentioned. Laurel Road’s Online Privacy Statement does not apply to third-party linked websites and you should consult the privacy disclosures of each site you visit for further information.

Sources:

https://www.irs.gov/retirement-plans/irc-457b-deferred-compensation-plans

https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-403b-tax-sheltered-annuity-plans

https://www.investopedia.com/ask/answers/060215/what-difference-between-401a-and-401k.asp

https://www.investopedia.com/ask/answers/100314/whats-difference-between-401k-and-pension-plan.asp

https://www.irs.gov/retirement-plans/traditional-iras#:~:text=A%20traditional%20IRA%20is%20a,filing%20status%20and%20income%2C%20and

https://www.investopedia.com/terms/i/ira-rollover.asp

https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-simple-ira-plans#:~:text=A%20SIMPLE%20IRA%20plan%20provides,either%20matching%20or%20nonelective%20contributions.

Don’t miss the latest financial resources.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Get tailored Laurel Road resources delivered to your inbox.

Search Results