Ever wonder what really goes into a student loan? As you might have guessed, it’s much more than just a simple lender-borrower transaction.

Perhaps you’ve been bombarded by a myriad of ads for lenders claiming the best terms and prices. The tech seems savvier than ever, the process relatively simple, and, in some cases, choosing a certain path could save you thousands of dollars over the life of you loan.

But how does it all work, and how do you know which particular loan is right for you?

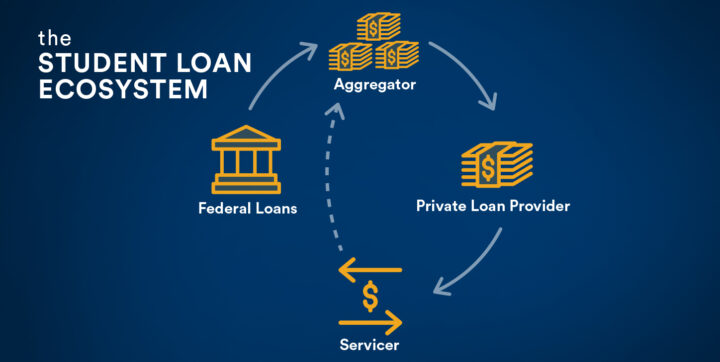

There are many players in the student loan ecosystem, and it’s worth taking some time to understand their unique roles. We’ll look at 4 of the most prominent types of student loan and lending-related sites in the market, with examples for each to help you understand how they work together and know what to expect.

1. Uncle Sam (federal government programs)

studentaid.gov

The office of Federal Student Aid, a division of the US Department of Education, provides billions of dollars in financial aid (the large majority of student loans) each year. They are likely your first stop in funding your education, and in many cases offer the best options (if you qualify) to take out and repay loans for a wide variety of life, financial, and educational backgrounds.

When it comes to repayment of federal student loans, you may have several options available to you such as Income-Driven Repayment (IDR) or Public Service Loan Forgiveness (PSLF). You might consider consolidation through the federal government to combine your direct loans into a single payment and switch from paying several loan servicers to paying just one, or refinancing to take advantage of a lower interest rate or shorter payment term. Given a strong credit history, you might be eligible for better rates—something many borrowers seek on a regular basis as interest rates fluctuate.

One thing to note—if you refinance federal loans with a private lender, you will not be able to go back to federal loans and may lose your federal benefits and repayment programs such as IDR and PSLF.

2. Aggregators

Aggregator sites, such as Nerdwallet or Bankrate, often provide financial advice and connect customers to offers from popular lenders to compare/contrast to their needs. Their membership model may offer credit score advice, spending tracking, and savings tips for the everyday customer. Lenders (like Laurel Road) may contract with aggregators to be featured on the site and get in front of borrowers like you looking for low rates and great service.

In addition to convenience and ease, aggregator sites’ business model has other advantages. They may provide a ‘snapshot’ of the market and rates, and they explain differences beyond price, highlighting lenders and personal banking products with thorough reviews and analysis.

Aggregators tend not to give preference to one lender over another, and present a menu of choices you’re likely to appreciate for its variety. They offer their own objective reviews, measured with specific pros and cons that may influence your individual experience.

Once you’ve settled on your preferred choice, you’ll be taken to the lender’s own site to begin the application process.

3. Private lenders

Another place you’ll find student loans and student loan repayment options on the internet is on the websites of private lenders. Private lenders do not offer income-driven repayments (IDR) and other repayment options that you have available under federal programs. If you’re exploring federal student loan repayment options, consider the benefits of federal loan forgiveness, and IDR, before looking into refinancing your federal student loans with a private lender. Some private lenders, including Laurel Road, may even offer a free 30-minute phone consultation with a student loan specialist to help you understand if you qualify for federal repayment and forgiveness programs.

If you have private student loans, exploring refinancing could be a smart move. You could be able to secure a preferable rate if factors such as your income and credit score have changed. Remember that a private loan’s variable interest rate will most likely change along with the federal interest rate, so you need to weigh that consideration when comparing variable and fixed rate options. Once you’ve chosen your private lender, you’ll begin working with their preferred servicer.

4. Servicers

While Laurel Road handles refinancing your loan and the application process, we don’t service your loan. The job of the servicer includes sending out monthly statements, processing payments, and progressing with you as you pay off your loan balance to keep you in good standing. Most lenders outsource this function to a servicer, such as MOHELA, Navient, or Nelnet, just to name a few.

While no servicer has a spotless record, the combination of the right education and advocacy from your private loan provider improves the chances of taking on debt successfully and responsibly. We have been, and always will be, committed to supporting transparency and fair practices in lending.

Trust your instincts

While no lending experience will be perfect, understanding the players and the intricacies of the process should help you start exploring what’s out there with a more informed, critical eye. If you still have concerns as to whether refinancing is right for you, check out our other resources, and don’t hesitate to reach out.

In providing this information, neither Laurel Road or KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Any third-party linked content is provided for informational purposes and should not be viewed as an endorsement by Laurel Road or KeyBank of any third-party product or service mentioned. Laurel Road’s Online Privacy Statement does not apply to third-party linked websites and you should consult the privacy disclosures of each site you visit for further information.