How to Create an Investment Plan

It’s time to build your investment portfolio. Your current financial situation, your investment goals, and your risk tolerance will provide the...

It’s time to build your investment portfolio. Your current financial situation, your investment goals, and your risk tolerance will provide the parameters to guide you. You have a whole host of different assets to choose from: equities (stocks), fixed income (bonds), options, commodities, real estate, private equity, venture capital, and more. You can keep it simple or make it as complex as you want, but your portfolio should reflect your parameters and it needs to be diversified.

What investments should you choose? This is the tricky part. There are many investments to choose from and it can get complicated quickly. For our purposes here, let’s assume you’re going to stick to equities and fixed income.

Let’s say you’re 40 years old and you’ve got $50,000 in savings. You’ve given it some thought, and you’ve come up with your financial goal: You want to retire at age 60 with $2 million. Now, how do you get there?

Say you’re planning on saving $40,000 per year. If you put that in your mattress, in 20 years, you’d have $850,000, leaving you short $1,150,000. If you want to reach $2 million, you’re going to have to earn a nearly 8% annual return for the next 20 years. That’s a healthy return, but it’s doable.

The challenge is to build an investment portfolio that will help you reach your goals while respecting your risk tolerance. Let’s look at a few sample portfolios composed of equities and fixed income and see what their historical returns have been.[1]

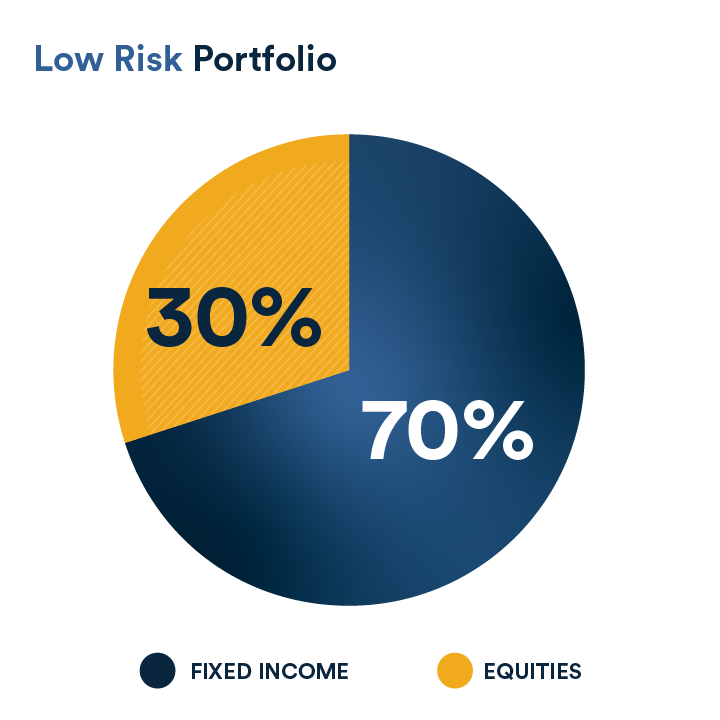

Low Risk Portfolio

Performance from 1926 to 2020

Average annual return: 7.7%

Best year: +38.3%

Worst year: –14.2%

Years that saw negative returns: 18

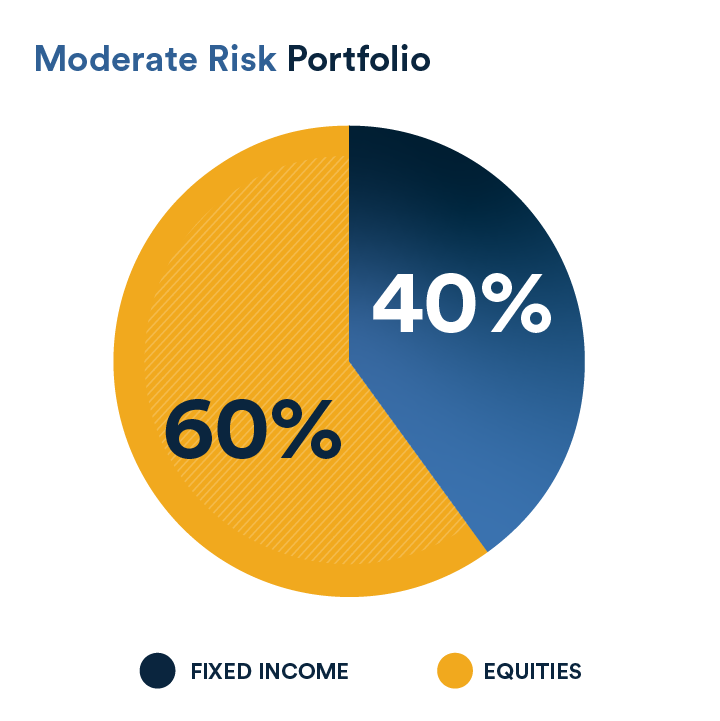

Moderate Risk Portfolio

Performance from 1926 to 2020

Average annual return: 9.1%

Best year: +36.7%

Worst year: –26.6%.

Years that saw negative returns: 22

High Risk Portfolio

Performance from 1926 to 2020

Average annual returns: 9.8%

Best year: +45.4%

Worst year: –34.9%

Years that saw negative returns: 24

Aggressive Risk Portfolio

Performance from 1926 to 2020

Average annual return: 10.3%

Best year: +54.2%

Worst year: –43.1%

Years that saw negative returns: 25

Historically, the moderate, high, and aggressive risk portfolios would have got you the returns you needed to reach your goals, with the low-risk portfolio coming up just a few thousand dollars short of $2 million. Keep in mind that these numbers are averages, meaning there were years where the returns were higher than the average and there were years where returns were lower than the average. Pay attention to the range between the year that saw the highest return and the year that saw the lowest return, as well as the number of years where returns were negative. You need to be prepared to have years where returns are negative. The key here is that you’re investing with a long-term horizon and the hope is that you’ll be able to make up for those negative years over time – which is why you should start investing as soon as possible.

One takeaway from the performances of the different portfolios above is that the performance is fairly similar despite the difference in the relative risk. The average return of the low-risk portfolio was only 2.5% below that of the aggressive risk portfolio while the worst year was only down 10% vs. 43%! Thus, you can still earn solid returns adopting a low-risk portfolio and avoid the worst of some of the large potential down years that will inevitably occur. That being said, over a long period of time like 20 years, the difference of a couple of percent in returns can translate into thousands of dollars. For example, our low-risk portfolio would have totaled $1.99 million after 20 years, while our aggressive risk portfolio would have totaled $2.7 million. In this case, the difference of 2.5% in return translates into a difference of over $700,000! Small numbers can make a big impact over a long period of time.

Another thing to keep in mind when we discuss allocating between equities and fixed income is the choice of the percentage allocation is only the first step. The next step is to decide what you’re going to invest in specifically. For example, if you decide to allocate 60% of your money to equities, you have to decide what equities you want to invest in. There are thousands of different equities to choose from, but this doesn’t mean you have to choose any of them–you can invest in an equities index fund and be done right there. Or you can try to select a number of individual companies. The same goes for investing in fixed income. It’s up to you. It can be as simple or as complicated as you want it to be.

Manage expectations or increase contributions

Let’s consider a different scenario where you were 40 years old and wanted to retire at age 60 with $2 million but had only $10,000 in savings and were planning on contributing $20,000 per year. In this case, you would need to earn an average annual return of over 14% to reach your goal! Although this is theoretically possible, it’s a bit of a stretch to plan for, let alone count on. A more than 14% annual return for 20 years is a high return expectation, even for someone with a high risk tolerance.

If your return needs are higher than is feasible or reasonable, then something has to give. You’ll need to either lower your expectations or increase your contributions. You could lower your financial goal, push out your retirement timeline, or increase your annual contributions to improve your chances of reaching your goal. The two easiest factors to modify are your timeline and your contributions, so those are the place to start. The one thing you can’t change is your risk tolerance. Risk tolerances can, and do, adjust as you get older and your income changes, and you can adjust your portfolio as needed to reflect those changes, but your portfolio should always reflect and incorporate your risk tolerance first, and your return needs second.

Create your plan

So, this is how you do it: once you know your investment goal and what kind of annual returns you need to earn to get there, you can set about building a portfolio of assets with the return characteristics that should help you meet your goals. Each asset class has historical returns over many years that can help you gauge their future potential. Keep in mind that past performance is no guarantee of future results and the returns from specific investments within asset classes can, and do, vary. Treat them as general indications of what is possible, as opposed to what you will receive.

Here are the steps:

- Determine how much you want to save (financial goal)

- Determine risk tolerance

- Choose asset allocation (% of equities, fixed income, other asset classes)

- Choose specific investments (index funds, mutual funds, ETFs, individual companies, other securities)

- Check on portfolio performance periodically (for passive investors, check quarterly. For active investors, check monthly or more often depending on the nature of the investments) and adjust allocations as necessary

- Continue to make regular contributions

In summary

You now know the basics of how to build an investment plan. There are a number of steps involved but it’s a manageable process if you just take it one step at a time. It doesn’t have to be complicated and the time you spend doing it will be repaid many times over. So, start now!

In providing this information, neither Laurel Road nor KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Any third-party linked content is provided for informational purposes and should not be viewed as an endorsement by Laurel Road or KeyBank of any third-party product or service mentioned. Laurel Road’s Online Privacy Statement does not apply to third-party linked websites and you should consult the privacy disclosures of each site you visit for further information.

[1] https://investor.vanguard.com/investing/how-to-invest/model-portfolio-allocation

Don’t miss the latest financial resources.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Get tailored Laurel Road resources delivered to your inbox.

Search Results