Benefits of Laurel Road Checking

Full-service checking with the convenience of a digital bank.

Online Bill Pay

Pay your bills from anywhere, anytime.

No Monthly Fees

No monthly maintenance fees or minimum balance requirements.

Loyalty Checking Welcome Bonus

Earn a $300 bonus with your first direct deposit.

For a limited time, you can earn a $300 bonus when you make qualifying ACH direct deposits totaling $2,500 or more within 60 days of opening your new Laurel Road Loyalty Checking account.3

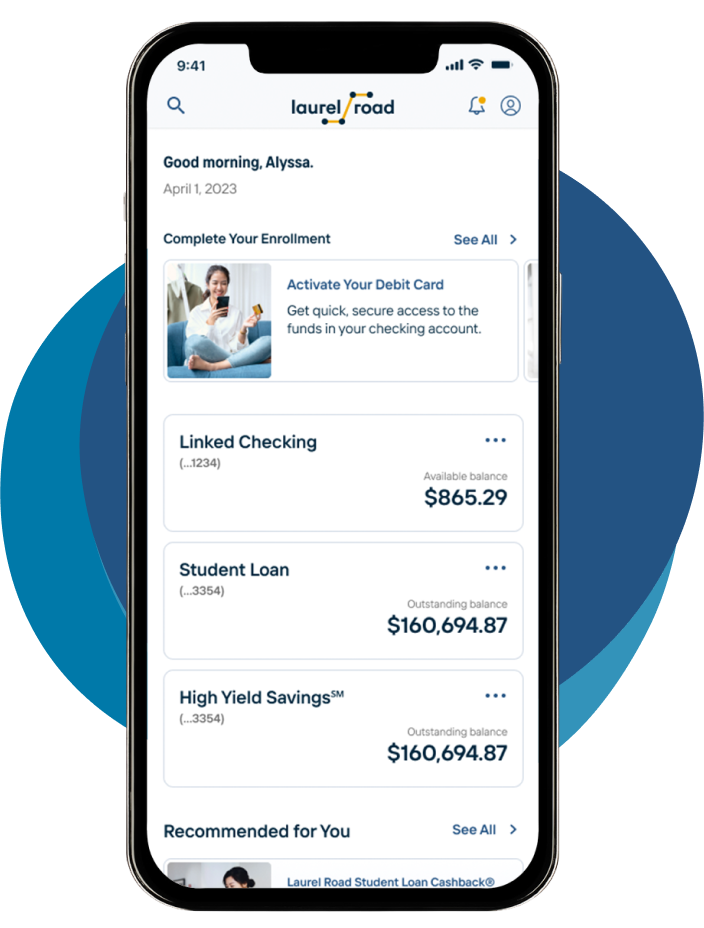

Laurel Road Mobile App

Bank On-the-Go. Anytime. Anywhere.

Get fast, easy, secure access to your Laurel Road accounts in one place: view account balances and activity, send and receive money with Zelle®, deposit checks, manage bill payments, and more—all available 24/7, right from your mobile device.

Get Early Access to Your Pay

Access your pay – up to 2 days early8 with Laurel Road Checking.

With our Early Pay service, you can access certain direct deposits – like your paycheck – up to two days before your pay date, at no extra cost to you.

Learn MoreLaurel Road Linked Checking offers you the ability to receive a discount off your Laurel Road student loan refinance, while Laurel Road Loyalty Checking offers you a monthly cash reward – both with qualifying direct deposits. Both share many of the same online checking benefits and features, such as access to over 40,000 no-fee ATMs nationwide,* $0 to open the account, $0 maintenance fee, free debit card and paper checks, mobile and online banking, and much more.

- *No surcharge when using your Laurel Road debit card at KeyBank ATMs or Allpoint ATMs located within the 50 United States and Washington D.C. Click Here to find ATMs near you.

- No, you can only have either a Linked Checking or a Loyalty Checking account open at the same time.

- You may open a standard Laurel Road Checking account and have that account open at the same time as a Loyalty Checking or Linked Checking. However, the additional account will not be eligible for the rewards component (either the student loan discount or the cash reward).

To earn monthly rewards, you must make qualifying ACH deposits into your Laurel Road Loyalty Checking account totaling at least $2,500 during the statement period. Rewards will be deposited into your Laurel Road Loyalty Checking account in the statement period after they are earned. <Qualifying Direct Deposits – A pre-arranged electronic direct deposit through the Automated Clearing House (“ACH”) Network from most employer payrolls, payroll provider (excluding third-party advance payroll service providers), benefits payer such as Social Security or Military Pay, or pension. Non-Qualifying Deposits – Including but not limited to: Point-of-sale (POS) and internet-initiated mobile entry (WEB) ACH transactions; incoming Person-to-Person (P2P) payments made via the ACH Network such as Zelle, PayPal, Cash App, or Venmo (including payroll-related transactions made via P2P providers); mobile check deposits; wire transfers; cash deposits; one-time direct deposits such as tax refunds and corporate reimbursements; internal transfers between Laurel Road or KeyBank accounts; external transfers from another financial institution; and insurance payments and other similar transactions. Laurel Road, in its sole discretion, reserves the right to deem any deposit either a qualifying or non-qualifying direct deposit, as applicable.

The welcome cash bonus will be deposited into your checking account within 60 days of meeting the requirements. For more information on qualifying direct deposits for the welcome bonus, click here.

Personal Checking Account Fees and Disclosures

Effective July 15th, 2024

Laurel Road is a brand of KeyBank N.A. All products are offered by KeyBank N.A. Member FDIC. ©2024 KeyCorp® All Rights Reserved.

Laurel Road CheckingSMAccount

Laurel Road Loyalty CheckingSM Account

Laurel Road Linked Checking®Account

Laurel Road Freedom Plus CheckingSM Account

Account Opening and Usage

All fees, services and rates are applicable to all three accounts mentioned above.

| Minimum Deposit Needed to Open Account | $0.00 | |

| Monthly Maintenance Service Charge | $0.00 | |

| Pays Interest | Yes | Variable rate of interest. See the “Interest Information” section below. |

| ATM Fees* | $0.00 | Each time you use a KeyBank ATM |

| $0.00 | Each time you use your KeyBank Debit Mastercard at an ATM within the Allpoint ATM Network | |

| $3.00 | Regional ATM Withdrawal Fee charged separately for each transaction at another bank’s ATM within the U.S. Assessed at the end of each statement period. Transactions include transfers, cash withdrawals, and purchases made at an ATM. | |

| $5.00 | International ATM Withdrawal Fee charged separately for each transaction at an ATM outside the U.S. Assessed at the end of each statement period. Transactions include transfers, cash withdrawals, and purchases made at an ATM. | |

| Foreign Transaction Fee | 0% | Fee charged on the amount posted for each Debit Card or ATM transaction processed in a foreign currency or outside the U.S., in addition to any fee added by a network or charged by an ATM owner. Exchange Rate may affect posted amount. Fee is assessed with the foreign transaction. |

| Chargeback Fee | $0.00 | For each check deposited to your account that is returned to us unpaid. |

| Stop Payment Charge | $34.00 | For each stop payment or to renew a stop payment on a check or withdrawal or on multiple checks in sequence. |

| Other Service Charges | Please consult the Other Service Charges section of this document for a list of additional service charges. |

*Please refer to the KeyBank Disclosure Statement and Terms and Conditions for Electronic Fund Transfer Transactions for additional information.

Overdraft Services

| Standard Overdraft Services1 | We MAY choose to pay/process certain items into overdraft. You may ask us not to pay/process any of these items into overdraft:

We DO NOT authorize and pay the items listed below into overdraft. However, you may ask us to pay these items into overdraft:

If we DO NOT authorize and pay an overdraft, your transaction will typically be declined. |

|

| Key Coverage Zone® | No Overdraft Item Charge or Recurring Overdraft Service Charge will be assessed if your end of day overdraft balance is $20.00 or less. | |

| Overdraft Item (OD) Charge | $20.00 | Per overdraft item when the end of day overdraft balance is greater than $20.00 |

| Daily OD Charge Cap | 3 | Based on transactions posted to the account each day2 |

| Monthly OD Charge Cap | 20 | Based on transactions posted to the account within the monthly statement period3 |

| Recurring Overdraft Service Charge | $20.00 | If your end of day account balance remains overdrawn by more than $20 for five consecutive business days5 |

| Overdraft Protection Plans4 | $00.00 | Cost per transfer from your Laurel Road:

|

| Return Item Charge | $00.00 |

- Paying your account into overdraft is done at Laurel Road’s discretion.

- In rare cases, OD Charges may not post on the same day as the transaction which triggers the fee(s). As a result, more than 3 OD Charges may post to your account on a single day, but you will never be assessed fees for more than 3 transactions posted per day.

- If more than 20 OD Charges are incurred within the monthly statement period, we may, in our discretion, continue to pay items into overdraft, but you will not be assessed additional OD Charges for such transactions.

- Please see your respective disclosure statement for more information.

- This fee is based on end of day current (ledger) balance.

Current (ledger) balance shows the total amount of money in your account at the end of the day, but the total amount may not be ready for use.

*Available balance is the amount of money in your account available for use. This balance does reflect deposit and withdrawal transactions that have not yet posted. For more detail on transaction posting please reference section 6 of your Deposit Account Agreement and Funds Availability Policy.

Processing Policies^^

| Posting Order: The order in which specific deposit and withdrawal transaction categories post to your account. |

Sort order for primary posting categories each business day: We post ATM and debit card transactions based on authorization date/time; if authorization date and time are not available, we use settlement date and time. We post checks, if applicable, in check number order. For all other types of items within each posting category we will post items from lowest dollar amount to highest dollar amount. |

| Deposit Hold Policy: When funds deposited to your account become available |

For all personal deposit accounts our policy is to make funds from cash and check deposits available on the first business day after the day we receive the deposit with certain exceptions. |

^^Please see the Deposit Account Agreement and Funds Availability Policy for details.

Dispute Resolution

| Dispute Resolution Agreement | Please see the Deposit Account Agreement and Funds Availability Policy for the Arbitration Provision which includes important information concerning your right to reject arbitration. |

Interest Information

| Balance Tier | Interest Rate | Annual Percentage Yield (“APY”)* |

| $.01 – $2,499.99 | 0.010 % | 0.01 % |

| $2,500 – $4,999.99 | 0.010 % | 0.01 % |

| $5,000 – $9,999.99 | 0.010 % | 0.01 % |

| $10,000 – $24,999.99 | 0.010 % | 0.01 % |

| $25,000 – $49,999.99 | 0.010 % | 0.01 % |

| $50,000 – $99,999.99 | 0.010 % | 0.01 % |

| $100,000 – $249,999.99 | 0.010 % | 0.01 % |

| $250,000 – $499,999.99 | 0.010 % | 0.01 % |

| $500,000 – $999,999.99 | 0.010 % | 0.01 % |

| $1,000,000 and above | 0.010 % | 0.01 % |

Please note that there could be more than one interest rate balance tier earning interest at the same interest rate.

*The Interest Rates quoted and corresponding Annual Percentage Yields (“APY”) are those which were in effect on the day the account was opened or an inquiry was made. The applicable Interest Rate applies to the entire balance in the account. Rates are guaranteed only to the extent specified in this Personal Checking Account Fees and Disclosures.

Current Interest Rate information may be obtained by contacting Laurel Road customer service at 1-833-427-2265, or writing Laurel Road P.O. Box 191, Bridgeport, CT 06601. Dial 711 for TTY/TRS.

This account pays interest at a variable interest rate and rates may vary based on the balance in your account. We may change the interest rate and APY at our discretion and as often as daily. There are no limits on the amount that the interest rate or APY may change.

The Daily Balance is the balance in your account each day. We use the Daily Balance method to compute interest on accounts. This method applies a daily percentage rate to the balance in the account each day. To determine the daily percentage rate, we divide the interest rate by 365 days. Interest begins to accrue on non-cash items, like checks, presented to us no later than the business day we receive credit for the deposit. Interest is compounded daily and credited to your account monthly.

If you close your account within ten business days after the last interest payment date, the accrued but not yet credited interest will not be paid. If you close your account after the tenth business day, interest accrued up to, but not including, the day of withdrawal will be paid at closing.

Other Service Charges

| Statement Charges | ||

| Paper Statement Fee | $0.00 | To receive your account statement on paper instead of electronically. This charge is assessed per monthly statement period. |

| Returned Statement Handling Charge | $10.00 | For statements returned to the Bank due to an incorrect address. Fee is applied when Key receives a returned statement and is processed prior to the Posting Order process described in the Deposit Account Agreement and Funds Availability Policy. |

| Charge for Each Additional Copy of Statement | $6.00 | Fee for each copy of a statement requested from a Bank representative. |

| Duplicate Statement Service Charge | $0.00 | For a duplicate copy of your deposit account statement. For combined deposit statements only your primary Account will be assessed the monthly charge. |

| Miscellaneous Other Charges | ||

| Card Replacement | $0.00 | Standard delivery: 3-5 business days |

| $25.00 | Rush delivery: 2-3 business days | |

| Inactive Fee and Interest Reduction | $0.00 | Your account will be charged the fee and your interest rate will be changed to .01% if:

This fee is in addition to any other normal account service charges incurred. A notice will be mailed prior to your account being classified as inactive. You may avoid the inactive classification by making a deposit or withdrawal (includes recurring ACH transaction activity). |

| Fedwire Service Charge | $20.00 $30.00 $45.00 |

Each Incoming Domestic and International Each Domestic Outgoing Each International Outgoing Fee is assessed with the wire transfer |

| Book to book Wire Transfer | $4.50 | Domestic Outgoing Wire to a Key Account Domestic Incoming wires to Key accounts are not charged a fee Fee is assessed with the wire transfer |

| Repetitive Outgoing Wire Transfers | Repetitive wire transfers are those in which debit and credit transfer parties remain the same (date and dollar amount may be different) and will be discounted $10.00 from the standard Fedwire Service Charge prices. | |

| Legal Order Processing Fee | Up to $100.00 | For processing court orders served against you such as Garnishments, Levies, or Delinquent Child Support Orders. Fee is applied when Key processes Legal Order items and is processed prior to the Posting Order process described in the Deposit Account Agreement and Funds Availability Policy. |

Limits on Dollar Amounts of Card Transactions

| Limits are based on the card you use. Separate withdrawal and purchase limits apply. Total withdrawals or purchases in any one day may not exceed the separate Daily Limits for a single Card number, regardless of the number of Accounts that a single Card may access. These are the standard limits that come with your card, but you can request a different ATM or Purchase Limit. | |||

| Debit Cards | Daily Signature/PIN Purchase Limit | Daily ATM Withdrawal Limit | Allpoint ATM Network Eligible |

| Laurel Road World Debit Mastercard ® | $10,000.00 | $1,000.00 | Yes |

| At some types of ATMs, the withdrawal amount may be limited due to machine constraints, and multiple transactions may be necessary to obtain the total amount desired. | |||

Accounts Welcome Bonus Offers

Laurel Road Loyalty CheckingSM Account

You must open a Laurel Road Loyalty Checking account by 08/29/2024 at 11:59 p.m. (ET) and make one or more qualifying direct deposits via an Automated Clearing House (ACH) transaction into the Laurel Road Loyalty Checking account totaling at least $2,500 within the first 60 days after account opening to receive the $300, which will be deposited into your account within 60 days of meeting requirements.

Qualifying Direct Deposit – A pre-arranged electronic direct deposit through the Automated Clearing House (“ACH”) Network from most employer payrolls, payroll providers (excluding third-party advance payroll service providers), benefits payers such as Social Security or Military Pay, or pension.

Non-Qualifying Deposits – Including but not limited to: Point-of-sale (POS) and internet-initiated mobile entry (WEB) ACH transactions; incoming Person-to-Person (P2P) payments made via the ACH Network such as Zelle, PayPal, Cash App, or Venmo (including payroll-related transactions made via P2P providers); mobile check deposits; wire transfers; cash deposits; one-time direct deposits such as tax refunds and corporate reimbursements; internal transfers between Laurel Road or KeyBank accounts; external transfers from another financial institution; and insurance payments and other similar transactions.

Laurel Road, in its sole discretion, reserves the right to deem any deposit either a qualifying or non-qualifying direct deposit, as applicable.

You are not eligible for the bonus if you were the primary owner on any Laurel Road checking account within the prior 24 months before opening the new checking account. The bonus value may be reported to the IRS on Form 1099-INT. Accounts must be in good standing and cannot be closed at the time of bonus payment. Offer is subject to cancellation without notice and cannot be combined with any other checking account bonus offer. Laurel Road is not responsible for, and will not honor, promotional offers that appear on third-party websites that are not authorized by Laurel Road. Normal account service charges and miscellaneous charges may apply to the Laurel Road Loyalty Checking, which may reduce earnings.

This Personal Checking Account Fees and Disclosures (“Disclosure”) provides information about deposit accounts we offer. While this Disclosure is accurate as of the effective date above, specific product features may be changed from time to time. A copy of the current Disclosure may be obtained upon request by contacting us.

Your account is also subject to our Deposit Account Agreement and Funds Availability Policy.

How to get more information:

- Visit us at laurelroad.com

- Call us at 1-833-427-2265

- Dial 711 for TTY/TRS

072024COMP-1665