What’s one of the most important numbers that isn’t calculated by you but has a big impact on your life? Your credit score. It’s a number between 300 and 850 and it measures your creditworthiness. Your ability to access credit can play a crucial role in major life events, like determining whether you can go to college or buy a house — if you don’t have money already saved up, you might be able to borrow it if you have good credit. Given its importance, let’s take a look at how your credit score is calculated.

How is your credit score calculated?

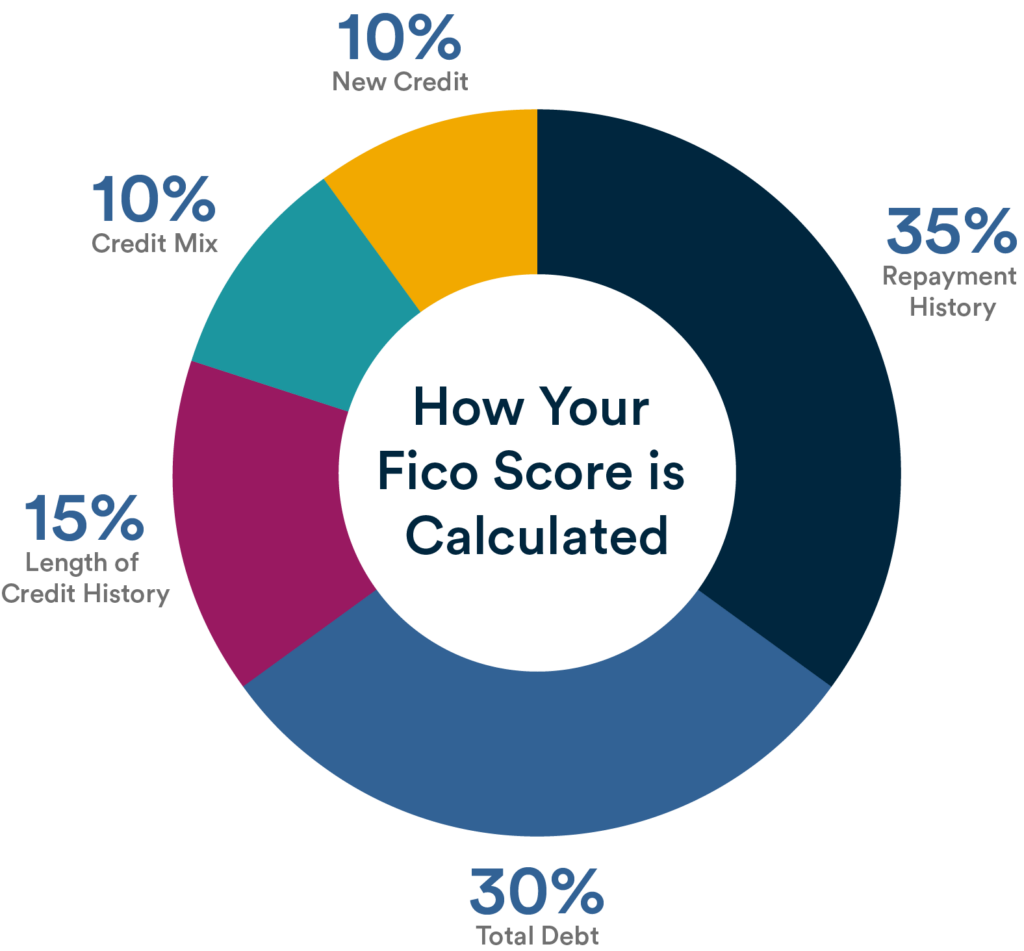

The main criteria used to calculate your FICO score are as follows[1]:

- your repayment history (35% weight)

- your total debt (30% weight)

- the length of your credit history (15% weight)

- your credit mix (10% weight)

- your new credit accounts (10% weight)

While there are other methods for calculating credit scores, FICO (named after its creator, Fair Isaac Corporation) is the method used by most financial institutions and credit bureaus. According to myfico.com, 90% of top lenders[2] use FICO scores to make decisions about credit approvals, terms, and interest rates, so that’s the one we’re going to focus on here.

The first thing to know is you don’t have just one credit score. For example, each credit agency (there are three main ones: Experian, TransUnion, and Equifax) may have a different score for you because they may not all have the same information about you. Make sure to check your score with each of them if you’re in the market for a loan or a new credit product.

The next thing to realize is that different lending products may also use different methods to calculate your score. For example, the data a mortgage lender might look at, or emphasize, can be different than a student loan provider.

It might seem complicated, and it can be at times, but the five main criteria used to calculate your credit score will stay the same, while the relevant weights given to each may vary by credit agency and lending product.

Let’s take a closer look at each of these criteria.

FICO Criteria

-

Repayment history (35% weight)

At 35%, this criterion has the heaviest weight, which makes sense because it’s your history of repaying the debts you owe. If you have a good history of paying your debts in full and on time, it will likely be reflected in your credit score.

-

Your total debt (30% weight)

The total amount of debt you owe is the second most important criterion in your credit score, hence the 30% weight. Any lender who is considering extending you credit is going to want to know how much money you already owe.

FICO breaks the total amount you owe into five categories:

- How much you owe on all of your accounts – This is straightforward: FICO looks at your total debt. One thing to note is that the balance of what you owe is what will show up here, so even if you pay off all your credit cards each month, the balance on your statements is what shows up in your credit report, not your current balance.

- How much you owe on different types of accounts – FICO considers what debt you owe in different types of accounts, be they credit cards (revolving debt), your student loans (installment debt) or whatever other forms of debt you may have.

- How many of your accounts have balances – FICO looks at how many of your debt accounts have balances. The more that do, the greater the chance you might be overextended.

- Your credit utilization on revolving accounts – Revolving credit accounts includes things like credit cards where you have a credit limit and can borrow up to that limit. Credit utilization is the amount of credit you’re using relative to your total credit limit. This can be measured on an overall basis or on an individual account basis. For the purpose of amounts owed for your credit score, it’s measured on your total revolving credit. For example, if you have total debt of $10,000 across multiple credit cards and your total credit limit on those cards is $20,000, your overall credit utilization is $10,000/$20,000 = 50%. If you have a high utilization rate, it might negatively impact your credit score. Funnily enough, having some debt might be better than having none at all. FICO notes that “in some cases, a low credit utilization ratio will have more of a positive impact on your FICO Scores than not using any of your available credit at all.”[3] This is an example of how your credit score can be a little confusing, but remember, it’s a tool to try and figure out how likely you are to repay your debts, so in this case, it’s better to have some debt to show you can pay it back.

- How much you still owe on your installment account compared to the original amount – Installment credit includes accounts like student loans and mortgages, where you’ve borrowed a set amount and are repaying it in monthly installments. If you have student debt of $100,000 and have already paid off $40,000 of it, then you’re showing that can manage and pay down installment debt, which should reflect positively on your credit score.

-

The length of your credit history (15% weight)

Generally, the longer your credit history, the better, because this gives lenders more information about your borrowing and repayment habits. But it’s not as important as how much debt you have and how diligent you’ve been in repaying your debt.

-

Your credit mix (10% weight)

There are different types of credit accounts, including credit cards, student loans, mortgages, and more. These accounts fall into two main categories: revolving and installment (see above). Lenders like to see borrowers with a mix of each because it demonstrates you can manage competing debt priorities.

Of the two, revolving credit tends to have a greater impact on your credit score because the amount you owe will often vary from month to month and it demonstrates your ability to manage your finances. For example, if your credit card debt is $1,000 one month and then $5,000 the next month and you pay off both balances in full, it demonstrates your ability to manage varying debt levels with your existing income.

-

Your new credit accounts (10% weight)

This factor looks at your recent new credit account history: how many new accounts you’ve applied for, how many you’ve opened, and when the latest one was opened. A high amount of recent activity can be a sign of greater credit risk to a lender, which can have a negative impact on your credit score. In most instances, opening a new credit account can result in a negative hit to your credit score, but as you demonstrate your ability to manage a new credit account over time, it can actually end up improving your credit score in the long run.

Your score in each of these categories is calculated and then totaled up. FICO defines the different ranges as follows:

Range of FICO scores[4]

| <580 | Poor | Well below the average score of U.S. consumers and indicates you’re a risky borrower. |

| 580-669 | Fair | Still below the average score of U.S. consumers, but many lenders will approve loans with this score. |

| 670-739 | Good | This is around the average of U.S. consumers and is considered by most lenders as a good score. |

| 740-799 | Very Good | Above the average of U.S. consumers and indicates you’re a very dependable borrower. |

| 800+ | Exceptional | High above the average score of U.S. consumers and indicates you’re an exceptional borrower. |

Note that a credit score of 670 or below is generally considered to be “subprime,” meaning that lenders view you as a higher risk borrower and might charge you higher interest rates, offer shorter terms and potentially require a co-signer to compensate for the risk they take in lending to you. In contrast, borrowers with scores above 700 may often be offered better rates and terms.

Your FICO Score and getting a mortgage

Your FICO score becomes really important when it comes time to look for a mortgage. Given the large size of most mortgage loans, mortgage providers use a different approach to evaluating prospective borrowers than say, a credit card issuer.

The biggest difference is the use of a tri-merge credit report, unique to the mortgage industry, that pulls and merges your credit data from each of the three main agencies (Experian, TransUnion, and Equifax). The comprehensive report includes your credit score from each agency and the mortgage provider will often use the middle number of the three agency scores for your mortgage application.

Ideally, you’ll have a high credit score when you apply for a mortgage. The higher your score, the lower the risk you present to lenders, and the likelier it is you’ll be offered a mortgage with an attractive interest rate. A difference of only 0.5% in your interest rate can add up to thousands of dollars over the term of your mortgage, so it pays to have a high score! Check out FICO’s site to see the different rates you can expect to receive based on different FICO scores and how that can translate into higher and lower monthly mortgage payments.

In summary: Why your credit score matters

Your credit score helps loan and credit providers determine how risky you are as a potential borrower. It plays a major role in determining how easy it is for you to take on debt and how much it will cost you, particularly if you’re looking to, say, refinance a mortgage or refinance your student loans. The benefit of having a good credit score is that you are typically more likely to be offered better rates and terms – and that means you’ll save money. If you’re not sure what yours is, you can check out your FICO score at myfico.com. Check your credit score today and, if necessary, work on improving it — it could save you money now, and in the future!

[1] https://www.myfico.com/credit-education/whats-in-your-credit-score

[2] Credit Scoring: How Credit Scores Help You | myFICO | myFICO

[3] How Owing Money Can Impact Your Credit Score | myFICO | myFICO

[4] https://www.myfico.com/credit-education/credit-scores

In providing this information, neither Laurel Road or KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Any third-party linked content is provided for informational purposes and should not be viewed as an endorsement by Laurel Road or KeyBank of any third-party product or service mentioned. Laurel Road’s Online Privacy Statement does not apply to third-party linked websites and you should consult the privacy disclosures of each site you visit for further information.