How to Manage Your Medical School Loans: Five Options to Consider

Navigating medical school debt is complex. Here's a how-to guide on managing your medical student loans from Laurel Road.

Anyone who’s had to deal with a Financial Aid office during undergrad knows that the world of student loan debt can be a confusing and intimidating place. And for postgrad physicians, residents, and fellows, it can be even more challenging. Below is a guide on how to manage your medical student loans.

So, what are your options?

Option 1: Give Yourself More Repayment Time

This option has to do with something called Forbearance. Student loan forbearance allows you to temporarily postpone loan payments or temporarily reduce the amount you pay. If you are granted a forbearance, you are still responsible for paying the interest that accrues during the forbearance period.

If you have a federal loan, there is a medical-resident-specific forbearance you may select which allows you to put your payments on hold for an extended period of time during training, although you will have to request it every 12 months. During this forbearance period, interest accrues and will be capitalized (added to your loan principal balance) at the end of the forbearance period.

There are two types of federal forbearance: discretionary and mandatory forbearance. Discretionary forbearance is when your loan servicer decides whether to grant forbearance.

Mandatory forbearance occurs when you meet the eligibility criteria for forbearance and the lender is required to grant forbearance. Here are three different examples of mandatory forbearance types:

- Medical or Dental Internship or Residency—Service in medical/dental internship or residency programs, and specific requirements are met

- Student Loan Debt Burden—The total monthly amount the borrower owes for all of their loans is 20%+ of their total monthly gross income

- Teacher Loan Forgiveness—The borrower is performing a teaching service that qualifies them for teacher loan forgiveness

For borrowers looking for other options regarding varying payment amounts over time should investigate the Graduated Repayment Plan and/or the Extended Repayment Plan.

Advantages of Forbearance

- Forbearance is a tool that allows a borrower to temporarily skip payments or temporarily make smaller payments

Disadvantages of Forbearance

- Forbearance is a short-term solution, not a long-term strategy

- Unpaid, accrued interest is added to the principal loan amount

- The borrower pays more over the lifetime of their loans

- It may be difficult to qualify for forbearance

More information around forbearance programs can be found here.

Option 2: Create the Super Loan

What is consolidation for federal student loans?

A new student loan is issued for each educational term/semester. Generally, borrowers are eligible to consolidate their federal loans after they graduate, leave school, or drop below half-time enrollment. A Direct Consolidation Loan allows you to consolidate (combine) multiple federal education loans into one loan. The result is a single monthly payment instead of multiple payments. Loan consolidation can also give you access to additional loan repayment plans and forgiveness programs.

Typically, the Direct Consolidation Loan has a fixed interest rate based on the weighted average of the interest rates of the consolidated loans. Repayment terms range from 10 to 30 years, depending on the loan amount.

Advantages of Direct Consolidation

One advantage is that your term length is inversely proportional to your payment amount. The longer the term length, the smaller the monthly payments.

Another advantage of Direct Consolidation is the simplicity associated with having a single fixed loan payment.

Disadvantages of Direct Consolidation

While consolidation may be convenient and could help lower your monthly payment, keep in mind that with a longer repayment period you could end up paying more over the life of the loan. Also, when you consolidate with the federal government, they take the weighted average interested rate and round it up to the nearest eighth of a percent. It may not sound like much, but over time, it could add up.

Direct Consolidation Loan Key Considerations:

| Pros | Cons |

|---|---|

| If you currently have federal student loans that are with different loan servicers, consolidation can greatly simplify loan repayment by giving you a single loan with just one monthly bill. | Because consolidation usually increases the period of time you have to repay your loans, you will likely make more payments and pay more in interest than would be the case if you didn’t consolidate. |

| Consolidation can lower your monthly payment by giving you a longer period of time (up to 30 years) to repay your loans. | When you consolidate your loans, any outstanding interest on the loans that you consolidate becomes part of the original principal balance on your consolidation loan, which means that interest may accrue on a higher principal balance than might have been the case if you had not consolidated. |

| If you consolidate loans other than Direct Loans, consolidation may give you access to additional income-driven repayment plan options and Public Service Loan Forgiveness (PSLF). (Direct Loans are from the William D. Ford Federal Direct Loan Program.) | Consolidation may also cause you to lose certain borrower benefits—such as interest rate discounts, principal rebates, or some loan cancellation benefits—that are associated with your current loans. |

| You’ll be able to switch any variable-rate loans you have to a fixed interest rate. | If you’re paying your current loans under an income-driven repayment plan, or if you’ve made qualifying payments toward Public Service Loan Forgiveness, consolidating your current loans will cause you to lose credit for any payments made toward income-driven repayment plan forgiveness or PSLF. |

More information around direct consolidation programs can be found here.

Option 3: Refinance Your Medical Student Loans

What are your refinancing options?

Refinancing provides the opportunity to pay off your original student loans by obtaining a new loan with different repayment terms and a potentially lower interest rate. Each lender has its own criteria for determining eligibility and rates, such as your credit history, total monthly debt payments, and income. Those who are in good financial standing, demonstrate a strong career trajectory, have good credit scores, and have shown they are responsible with debts and monthly budgeting are more likely to be approved with a potentially lower interest rate. Borrowers who do not meet these credit criteria might need a co-signer and/or need to work for some time before refinancing and obtaining a potentially lower interest rate.

Refinancing your student loans with private lenders may allow you to lower your rate in exchange for giving up protections and benefits of Federal loans. Terms range from 5 to 20 years with fixed and variable options.

Advantages of Refinancing Your Student Loans

Student loan refinancing may be a good option for those looking for an opportunity to do one or more of the following:

- Consolidate your private and/or federal loans into a single loan at a lower interest rate

- Save money over the life of your loans

- Pay off your loans more quickly

- Lower your monthly payments

- Change from a fixed rate to a variable rate, or vice versa

- Reduce the number of loans in repayment

- Gain terms and rates based on your current financial situation and creditworthiness

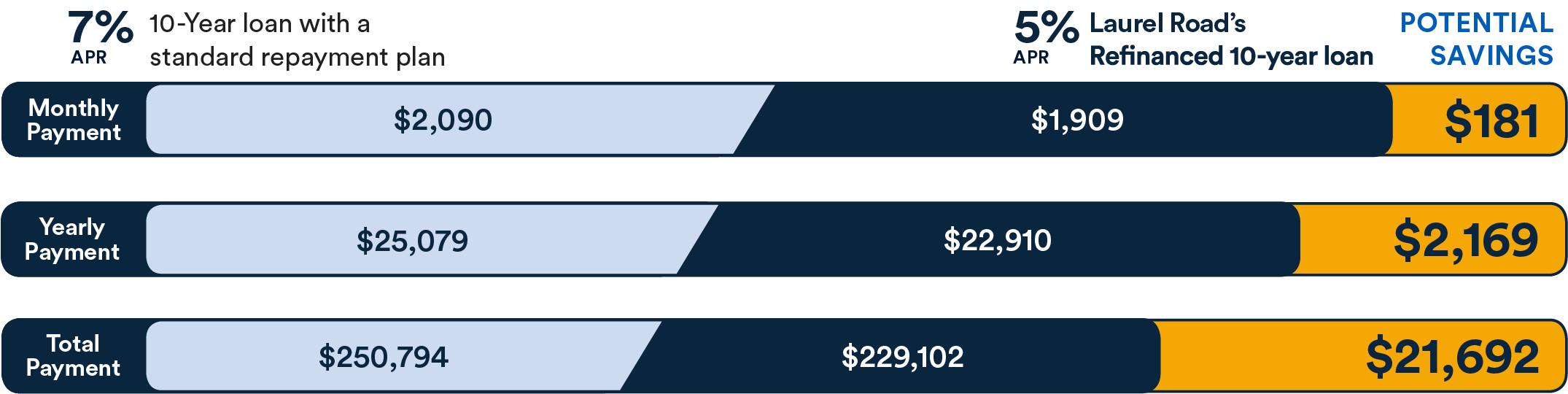

A change in an interest rate could impact the total repayment amount over the life of your loan. For example, borrowers with $180,000 in student loans could save roughly $20,000 if they could reduce their interest rate by 2%, please see example below.

What does a 2% interest rate reduction look like:

*Savings example based on loan size of $180,000 and is for illustrative purposes only. Savings vary based on rate and term of your existing and refinanced loan(s). Actual savings not guaranteed. Review your loan documentation for the rates of your previous loans and the total cost of your refinanced loan. The 7% and 5% Annual Percentage Rates (APRs) shown are hypothetical and may not reflect your actual rate. Rates and terms offered are subject to credit approval.

The key factors to consider are: Rate, Term, and Fixed vs. Variable. As the borrower, you will need to balance low rates with terms and payments you are comfortable with. As a borrower you may be able to lower your rate by refinancing your medical student loans in the private sector.

Disadvantages of Refinancing Your Student Loans

Before you consider private student loan refinancing, you’ll want to make sure you won’t be missing out on any of the federal programs, including income-based plans and loan forgiveness, discussed in more detail next.

Private student loan refinancing has other requirements that should be considered including requiring a credit history and proof of income.

For borrowers who choose to extend their loan repayment term for longer durations than their initial loan period they could end up paying more over the full life of the loan. Additionally, that payment amount will be locked in based on the terms of the loan.

Learn more about private student loan refinancing options with Laurel Road, including options for residents and practicing physicians, here.

Option 4: Plans Based on Your Income

What are Income-Driven Plans?

Income-driven plans adjust a borrower’s payments by reducing their monthly payment amounts according to their income. The payment amounts under income-driven plans are generally a portion of the borrower’s discretionary income. Repayment periods for all plans generally range from 20-25 years. There are four common income-driven repayment plans for federal student loans: Income-Contingent Repayment (ICR), Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

| Plan | Monthly Payments | Repayment Period |

|---|---|---|

| Income-Contingent Repayment (ICR) |

The lesser of the following:

|

25 years |

| Income-Based Repayment (IBR) |

|

20-25 years depending on when you became a New Borrower |

| Pay as You Earn (PAYE) |

|

20 years |

| Revised Pay as You Earn (REPAYE) |

|

20 (undergraduate) or 25 (graduate) years |

More information around income-driven repayment plans can be found here.

Eligibility will depend on when you graduated and when your loans were disbursed and more information on program eligibility and other potential options can be found here.

Advantages of Income-Based Plans

Advantages of all income-driven plans are that any remaining loan balance is forgiven if the borrower’s federal student loans are not fully repaid at the end of the repayment period. This allows borrowers with lower incomes to be eligible for student loan forgiveness.

Disadvantages of Income-Based Plans

There are many advantages to income-based plans, however, there are a few things to consider.

- You will need to recertify your income every year, and payments may increase or decrease for the next year based on your income and family size

- Over time interest accrues, and you could end up paying more interest over the life of the loan

- If a loan amount is forgiven, it may be taxable (currently not taxable under the American Recuse Plan Act of 2021 from January 1, 2021 through December 31, 2025)

Option 5: Public Service Loan Forgiveness

What is Public Service Loan Forgiveness (PSLF)?

Under this program, borrowers working in the public or non-profit sector can get their loans forgiven after 10 years of working in these sectors. If the borrower is employed in certain public service jobs and has made 120 qualifying payments on their direct loans, the remaining balance they owe may be forgiven. Qualifying employment is any employment with a federal, state, or local government agency, entity, or a non-profit tax-exempt 501(c)(3) organization.

Advantages of the PSLF program

The clear advantage of PSLF is forgiveness. Another advantage is that the amount forgiven is not taxed. For those who qualify, the PSLF Program can be invaluable in relieving a good portion of their debt.

Disadvantages of the PSLF program

There is no income requirement to qualify for PSLF. However, since your required monthly payment amount under most of the qualifying PSLF repayment plans is based on your income, your income level over the course of your public service employment might be a factor in determining whether you have a remaining loan balance to be forgiven after making 120 qualifying payments. One major factor when considering PSLF is time. PSLF requires 120 qualifying payments or 10 years before you can qualify for PSLF.

More information around the PSLF program and qualifying employers can be found here.

In Summary

Deciding how to pay off medical school loans and navigating the complex (and rapidly changing) world of federal and private loans is not without its challenges. You’ll want to explore all available options, including those with special options for medical professionals, so that you can make informed decisions on how you can pay off your debt, maintain your lifestyle, and ultimately get closer to financial peace of mind. Some programs may offer more flexibility and convenience right away, while others will require a long-term focus and commitment to reach your goals.

Given the rising cost of medical school, and graduates averaging $200,000+ in debt, managing student loan debt continues to present unique challenges for doctors today. If you are considering student loan refinancing, some private lenders like Laurel Road, offer special pricing for health care professionals or payments tailored to the unique needs of medical residents.

To learn more about refinancing your medical school loans with Laurel Road, click here.

In providing this information, neither Laurel Road or KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Any third-party linked content is provided for informational purposes and should not be viewed as an endorsement by Laurel Road or KeyBank of any third-party product or service mentioned. Laurel Road’s Online Privacy Statement does not apply to third-party linked websites and you should consult the privacy disclosures of each site you visit for further information.

Don’t miss the latest financial resources.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Get tailored Laurel Road resources delivered to your inbox.

Search Results